Plastic Bank’s technology advantage

Plastic Bank is a SaaS-driven social fintech that digitizes recycling ecosystems through tokenized reward programs, blockchain-secured traceability, and greenwash-proof consumer engagement.

What Plastic Bank can do that no one else can

We created the world’s first digitized plastic credit

Plastic Bank created the first digitally tokenized and traceable Plastic Credit, verifiably linked to physical recycling, with blockchain-secured proof of social impact.

An end-to-end circular economy infrastructure

We built the full tech stack to support Social Plastic collection, processing, validation, sales, reporting, and reinvestment — with auditability and automation at every step.

One platform, many solutions

From EPR compliance to household gamification, Plastic Bank enables enterprise, community, and individual participation in a single seamless system, connected by blockchain, AI, and tokenized rewards.

Our SaaS platform suite includes:

The PlasticBank App

A gig-economy infrastructure for the circular economy:

- Used by plastic collectors, recycling branches, processors, and households

- Supports traceability, gamification, and tokenized incentives

- Features:

- Blockchain-secured transactions

- AI-driven identity verification

- Tokenized digital wallets

- Digital Plastic Credit monetization

- Launched: 2017

- Coming January 1, 2026:

- Member Credit Scores

- Client-collateralized Token Advances

- Yield Fund for loan collateralization and reinvestment

- Zero marginal cost loan delivery and repayment

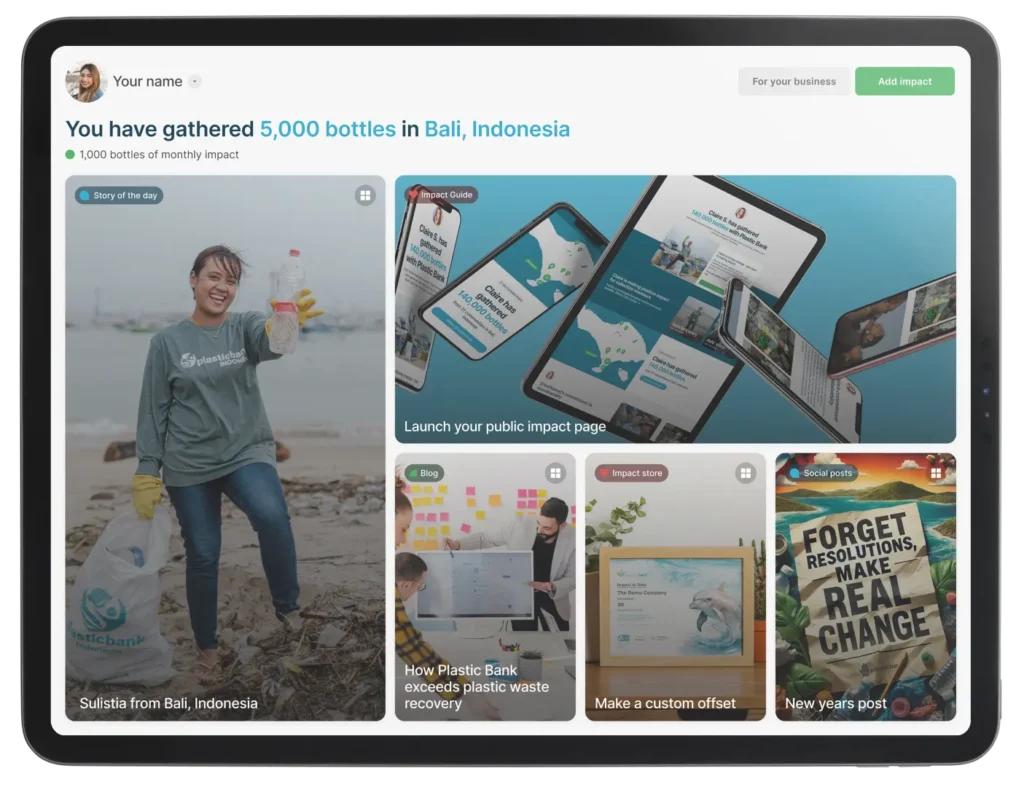

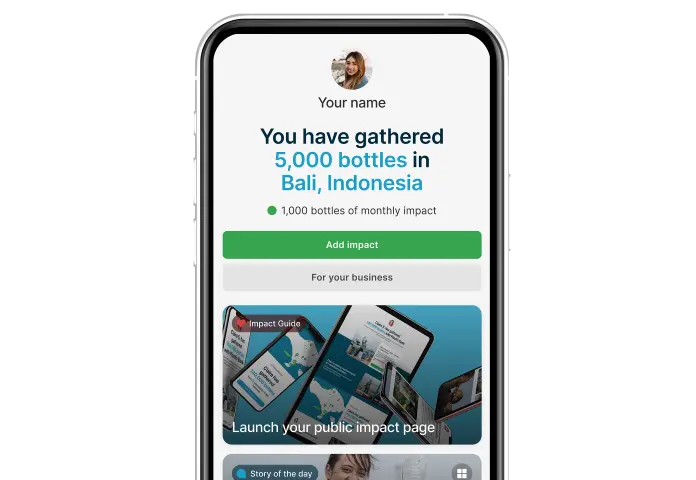

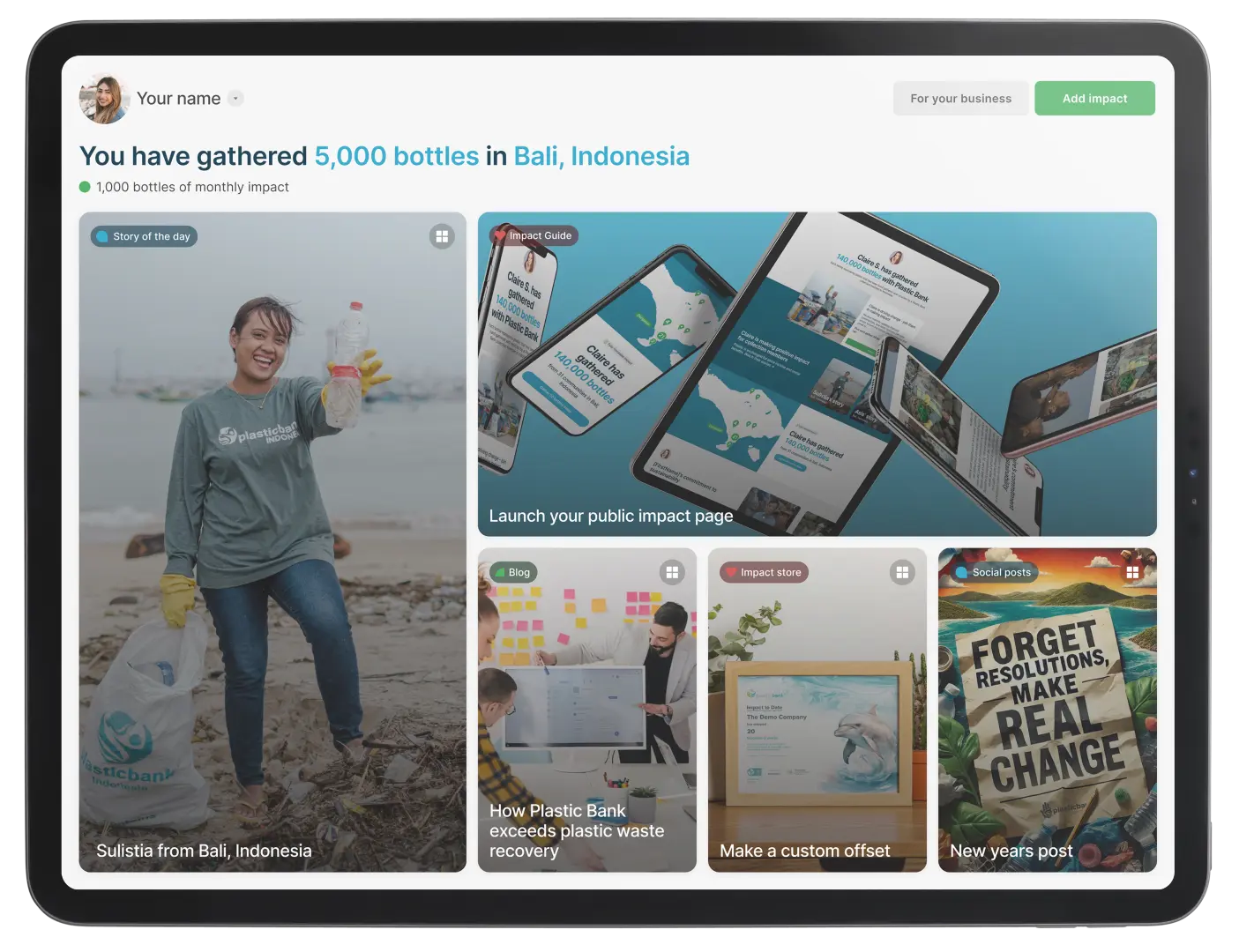

Individual Accounts

Empowers individuals with:

- Freemium and subscription tiers

- Personalized AI Impact Guide (AI-driven user profiling and recommendations)

- Gamified offsetting, tailored suggestions, and behavior nudges

- Official Launch: September 2025

- Coming January 2026:

- Affiliate profit-sharing programs

- Tools for everyday changemakers to grow their own “tribe” of impact

- Shared rewards from enrolled member activity

Small Business SaaS Accounts

Enable purpose-driven businesses to:

- Subscribe to purchase discounted Plastic Credits or make one-time purchases

- Access AI-curated, ready-to-post branded content

- Launch plug-and-play consumer loyalty programs

- Official Launch: September 2025

- Coming January 2026:

- Profit-sharing retail network programs

- Digital tribe building

- Cumulative tribe impact tracking and monetization

Enterprise SaaS Accounts

Self-service SaaS access for enterprise clients requiring:

- Blockchain-secured transaction records uniquely assigned to the customer

- Regulatory-compliant traceability (EPR, Social Plastic supply chains, and sponsorship orders)

- Agency-ready authenticated marketing assets

- Custom campaign and claims support

- Launched: 2020

Alchemy

Plastic Bank’s proprietary core operations platform that scales everything we do at zero marginal cost.

Capabilities include:

- Blockchain-secured traceability

- End-to-end Plastic Chain technology

- Digital Plastic Credit creation

- Tokenized payments

Digital asset monetization - AI-driven insights

- Automated auditing

- AI fraud detection

- Sales order fulfillment

- User management and admin tools

- Launched: 2017

- Coming 2027: Open to 3rd-party SaaS access

Deep dive into our proprietary tech stack

How Plastic Bank uses Blockchain

Hybrid blockchain for real-world efficiency

Plastic Bank has proudly implemented a cutting-edge hybrid blockchain solution that seamlessly integrates blockchain verification with our PostgreSQL database. This allows us to combine immutable trust with real-time performance, especially in vulnerable communities.

Key benefits of our hybrid approach:

Plastic Bank has proudly implemented a cutting-edge hybrid blockchain solution that seamlessly integrates blockchain verification with our PostgreSQL database. This allows us to combine immutable trust with real-time performance, especially in vulnerable communities.

- Immutable Trust: Every transaction is cryptographically anchored, with blockchain verification ensuring that our PostgreSQL data remains unaltered and audit-ready.

- Efficiency: Real-time app usage and reporting work even in low-data environments, making the system practical and inclusive.

- Environmental Sustainability: Designed to be energy-efficient, our blockchain solution aligns with our commitment to low-carbon operations.

- System Integrity: Ongoing quarterly and annual verification cycles maintain consistency and reliability across systems.

- Client Confidence: Clients gain real-time, verifiable data they can trust — no greenwashing, no uncertainty, just proof.

Trust as infrastructure

Our blockchain architecture doesn’t just validate — it creates trust as a core service, enabling partnerships, funding, and compliance in a transparent, secure way.

How Plastic Bank uses Artificial Intelligence

AI enables personalization, fraud prevention, and operational support.

User profiling & gamified engagement

Our AI engine powers the Impact Guide — creating personalized, purpose-driven journeys for individuals and businesses based on real usage data and behavioural patterns.

Fraud detection through pattern recognition

AI is used to identify fraud and abuse by scanning for irregular patterns in plastic collection behaviour, transaction histories, and system access logs — improving both internal safeguards and external accountability.

AI-Powered user support

Across all platforms, AI tools provide automated assistance, contextual guidance, and intelligent support, improving onboarding, retention, and operational efficiency.

What Plastic Bank can scale with zero marginal cost

Plastic credit creation, delivery & verification

Every credit is issued, tracked, and audited digitally — with no extra cost per unit or transaction.

Automated auditing & compliance

Our systems use blockchain and AI to generate real-time, audit-ready reports that scale with client usage — not headcount.

User onboarding, profiling & engagement

From global brands to individual households, our platform delivers personalized experiences at scale without extra human involvement.

Algorithmic end-to-end Traceability

PlasticChain algorithmically links each transfer of material — from every individual seller — all the way to the processor who purchased and recycled it.

- This allows every shipment to be traced back to its origin

- Every Plastic Credit can be tied directly to a verified recycling outcome

Authentic credit scoring for every user

Each user — from informal collector to supply chain partner — is assigned a dynamic credit score based on platform behaviour, unlocking future financial services.

Interest-free token advance

Users can qualify for, receive, and repay tokenized advances — interest-free — with all eligibility, delivery, and repayment handled algorithmically and instantly, at zero marginal cost.